ステークカジノ(Stake.com)日本語版公式サイトのご紹介

こんにちは! こちらのブログでは、世界中で注目されているオンラインカジノ、ステークカジノについてご紹介します。

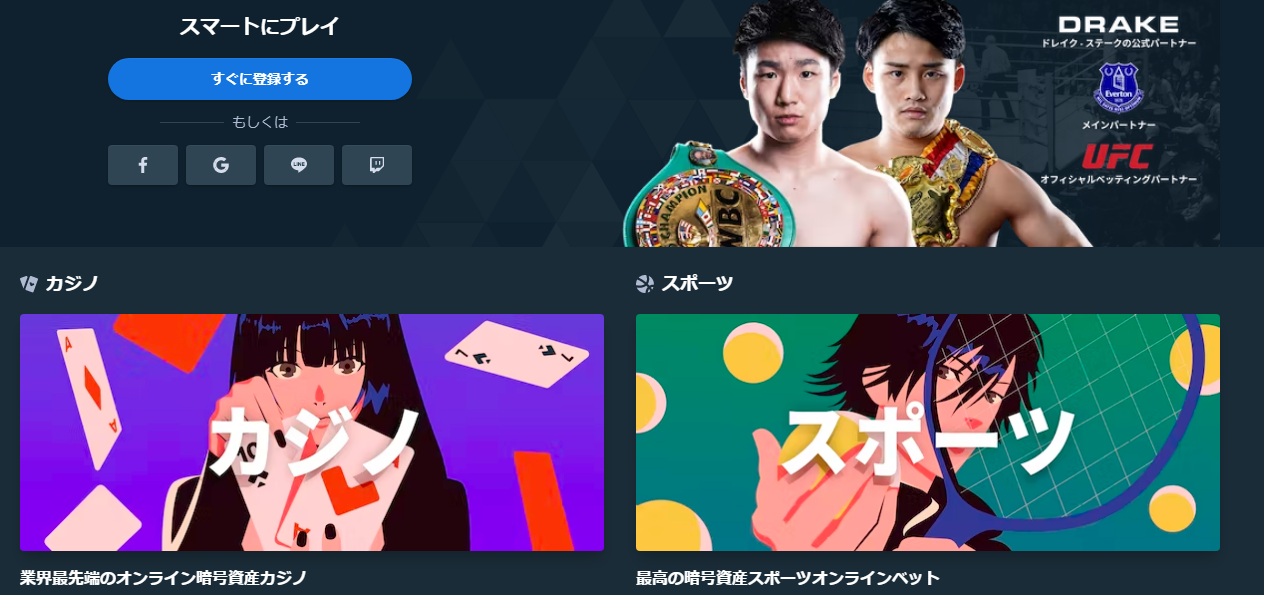

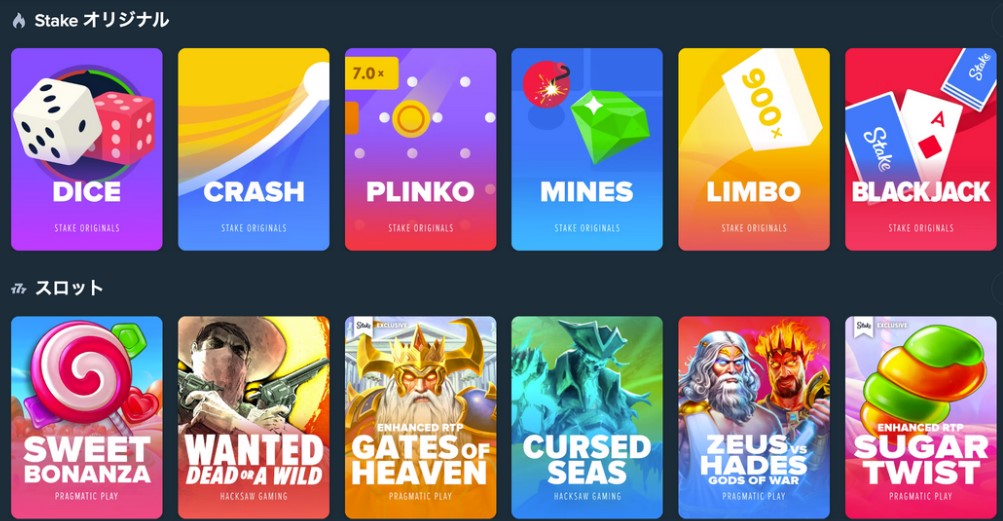

ステークカジノ(Stake.com)は、多彩なカジノゲームとスポーツベッティングを一つのプラットフォームで楽しめる場所です。

スロットマシン、ブラックジャック、ルーレットなど、多種多様なオンラインゲームを提供しているステークカジノ。リアルタイムでの対戦も可能です。

当ブログでは、ステークカジノのゲームルールや魅力的なゲームの紹介、勝利のコツなどを詳しく解説しています。ぜひチェックしてみてください!

↑1分で登録して、ベットするには今すぐクリック!↑

ステークカジノへの登録は手軽で簡単です。以下にその手順を説明します。

このサイトからステークカジノに登録すると、VIP級のレーキバック特典が受けられます。

登録手順は以下の通りです:

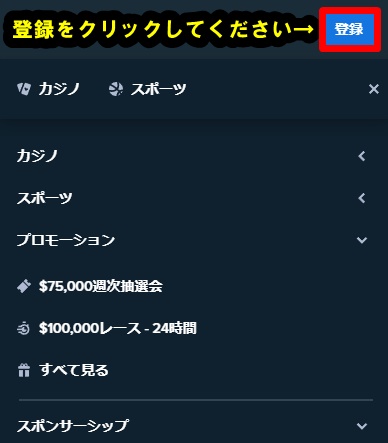

1.ステークカジノの公式サイトを開き、サイト右上の「登録」ボタンをクリックします。

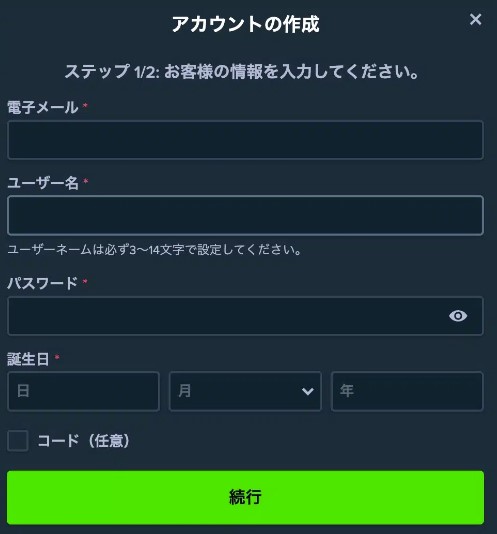

2.ページが新しいものに切り替わったら、以下の情報を入力してください:

メールアドレス(GmailやYahooメールなどのフリーメールを推奨)

ユーザー名(ニックネームでも構いません)

パスワード

誕生日

3.「続行」ボタンをクリックし、利用規約に同意したことを示すためにチェックマークを入れます。

4.「今すぐプレイ」をクリックすると、ステークカジノから認証用のメールが届きます。メール内の手順に従ってアカウントを有効化し、登録完了です。

「今すぐプレイ」を選択すると、ステークカジノから確認メールが送信されます。そのメールに記載された手順に従い、メールアドレスを認証し、アカウントをアクティブにすることで登録が完了します。

↑登録や詳細は今すぐクリック!↑

※レーキバックとは、ベットする度に一定量のコインが返還されるシステムを指します。キャンペーンコードを入力すれば、賭け金に対してハウスエッジの5%が返されます。

ステークカジノでは、安全性のため仮想通貨を含めたほぼ全ての通貨においてウォレットを使用する場合は本人確認(KYCレベル2まで)の登録が必須となりました。

ステークカジノ(Stake.com)は、オンラインカジノとスポーツベッティングを兼ね備えたプラットフォームです。総合格闘技団体UFCやワトフォードFCの公式スポンサーであり、ステークカジノ限定のオリジナルゲームも提供しています。季節やイベントに応じたボーナスもあります。

ステークカジノは仮想通貨に特化していますが、2022年3月からは日本向けに銀行振込による入出金が可能になりました。日本国内の銀行口座を使用すると便利ですが、日本円の取引には通常1日から最長3日かかることがあります。

KYC(本人確認)レベル2以上が必要ですが、日本語のサポートチャットは24時間年中無休で利用でき、いつでも質問することができます。

ステークカジノでは、初回入金で最大2000ドルの200%ボーナスが得られます。

このオファーは、当サイトを通じてステークカジノに登録し、100ドル以上を入金した場合に限ります。

【初回入金ボーナスが付与される条件】

・本人確認(KYCレベル2)完了済みの方

・当サイト経由でのステークカジノ登録者

・初回入金は最低100ドル

・出金条件:入金額とボーナス額の合計の40倍

・有効期限:なし

ボーナスは入金から3日以内に自動的にアカウントに反映されます。

ボーナスがアカウントに反映されるまでは、プレイを控えてください。ボーナスが付与された場合、賭け条件が満たされるまで出金はできません。プレイ不可のゲームが存在するため、利用規約で禁止ゲームのリストを確認してください。

本人確認のための書類の提示

ステークカジノでの本人確認プロセスはレベル4まであり、レベル2までの確認を済ませることで銀行送金、電子決済サービス、入金ボーナスなどの利用が可能になります。

レベル2では、本人確認に必要な書類(運転免許証、パスポート、マイナンバーカード等)をアップロードするだけでOKです。

レベル3に進むと、住所確認書類(住民票、クレジットカード明細、銀行明細、外国人登録証明書等)をアップロードすることで、入出金の上限額が増加します。

レベル4では、資金源の証明が求められる場合があり、その際は必要書類を提出します。

ステークカジノをオススメする理由は、大きく分けて3つ

私がステークカジノを推奨する理由は以下の3点です。

1.豊富なゲームラインナップ

ステークカジノではパズル、ブラックジャック、ルーレット、バカラ、ポーカーなど様々なゲームを提供し、ライブカジノも用意されており、本格的なカジノ体験が可能です。

2.高いセキュリティ

暗号化技術によりプレイヤーの個人情報や取引履歴が保護され、ゲームの結果はRNG(ランダム数生成器)によって管理されており、プレイヤーに公平なゲームプレイが保証されます。さらに、公的な機関による監督もあり、安心してプレイできます。

3.充実したボーナスとプロモーション

初回入金ボーナス、キャッシュバック、フリースピンなど、様々なボーナスやプロモーションが用意されています。定期的なトーナメントやVIPプログラムもあり、プレイヤーには多くの特典が提供されます。

これらの理由から、ステークカジノは多彩なゲーム、セキュリティの強化、豊富なボーナスとプロモーションでプレイヤーにとって魅力的なオンラインカジノです。

\1分で登録可能!/

ステークカジノ(Stake Casino)の魅力

ステークカジノでは、スロットマシン、ブラックジャック、ルーレット、ポーカーなど、様々なゲームを提供しています。これらは初心者からベテランまで幅広いプレイヤーに対応しています。

リアルタイム対戦可能:プレイヤーはリアルタイムでの対戦を楽しむことができ、他のプレイヤーと交流する機会も提供されます。

多彩なゲームラインナップ:スロット、バカラ、ブラックジャックなど、多種多様なゲームがステークカジノには揃っています。

安全性への配慮:個人情報や決済情報の安全を守るために、業界標準のセキュリティ技術が導入されています。

モバイル対応:スマートフォンなどのモバイルデバイスにも対応しており、どこからでもゲームを楽しむことができます。

柔軟な入出金方法:さまざまな支払い方法が利用でき、一部の方法では手数料が無料で、スムーズかつ経済的な取引が可能です。

ステークカジノはこれらの特徴を備え、安全で快適なオンラインカジノ体験を提供します。

\1分で登録可能!/

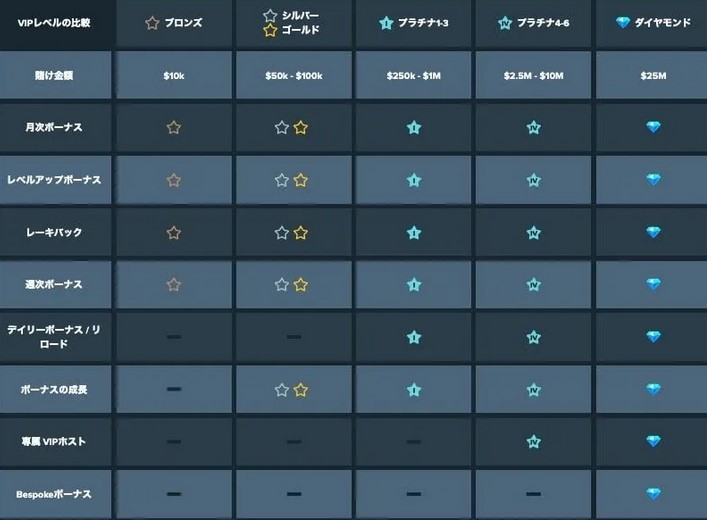

ステークカジノVIPクラブの特徴

ステークカジノのVIPクラブは、ユーザーのベット額に基づいてランクが定められ、各ランクごとに様々な特典が用意されています。VIPランクはブロンズ、シルバー、ゴールド、プラチナ、ダイヤモンドのカテゴリに分類されます。VIPメンバーには、レーキバックや毎週土曜日に提供される週間ボーナス、毎月15日頃に提供される月間ボーナスなど、多くの特典が用意されています。月間ボーナスはメールで通知されるため、Eメールの確認は欠かさないようにしてください。さらに、毎月15日前後にステークカジノから送信されるメールにも注目してください。

【ステークカジノのVIPクラブが人気の理由】

・レーキバック:ベット額の一定割合がキャッシュバックされる

・月次ボーナス:毎月15日頃にもらえるボーナス

・専用カスタマーサポート:VIP専用のカスタマーサポートが利用できる

・招待制イベント:VIP限定のイベントに参加できる

これらの特典は、いずれもプレイヤーにとってメリットのあるものばかりです。特に、レーキバックは、ベット額が多いほど還元率が高くなるため、ハイローラーにとっては大きなメリットとなります。

また、ステークカジノのVIPクラブには、VIP降格がありません。一度VIPランクに到達すれば、ベット額が減少してもVIPランクを維持することができます。

これらの理由から、ステークカジノのVIPクラブは、多くのプレイヤーから支持されています。

多くのオンラインカジノではVIPランクの維持が困難ですが、ステークカジノでは一度昇格するとランクが下がることはありません。VIPクラブで受け取るボーナスは出金条件なしで現金化が可能で、すぐに利用できます。昇格条件はベット額のみでわかりやすく設定されています。さらに、ステークカジノのテレグラムチャンネル(@StakeCasino)への参加も可能です。週次ブーストは毎週土曜日のGMT12:30にVIP専用テレグラムグループで配布されます。

| VIPランク | ベット金額 | レベルアップボーナス |

|---|---|---|

| ブロンズ | $10,000 | $15 |

| シルバー | $50,000 | $50 |

| ゴールド | $100,000 | $110 |

| プラチナ | $250,000 | $200 |

| プラチナII | $500,000 | $400 |

| プラチナIII | $1,000,000 | $800 |

| プラチナIV | $2,500,000 | $1,600 |

| プラチナV | $5,000,000 | $3,200 |

| プラチナVI | $10,000,000 | $6,400 |

| ダイヤモンド | $25,000,000 | $12,800 |

ステークカジノでVIPメンバーになる方法

1.ステークカジノに登録し、カジノゲームやスポーツベッティングに参加する。

2.ベットを重ねるたびに、VIPステータスの進行が進みます。

3.VIPレベル「ブロンズ」に到達した際には、ボーナスを請求してVIP特典を享受できます。

ステークカジノのVIPメンバーとして受けられる特典には、レーキバック、週間ブースト、月間ボーナスなどがあります。プラチナランクに達すると、リロードボーナスの受取も可能です。また、プラチナⅣランクからはVIP専任ホストが割り当てられます。

ステークカジノのVIPプログラムは、プレイヤーがより多くの報酬と楽しみを享受できるように設計されています。ステークカジノのボーナスを活用し、VIPランク「ブロンズ」を目指しましょう。このVIPプログラムにより、ゲームをより有利に楽しむことができます。

ステークカジノ(Stake Casino)のユーザーエクスペリエンスに関する概要

ステークカジノ(Stake Casino)は、ユーザーからの評価が高く、使いやすいと評判です。

ステークカジノのゲーミング体験

このオンラインカジノは、最先端のグラフィックを駆使して、現実に近いカジノの雰囲気を創り出しています。ゲームの種類も豊富で、プレイヤーは多様な選択肢から自分に合ったゲームを見つけることができます。

セキュリティとプレイヤーの安全性

ステークカジノは、プレイヤーの個人情報と取引のデータを守ることに力を入れており、安心して遊べる環境を整えています。

コミュニケーションとリアルタイム対戦

プレイヤー間でのリアルタイム対戦が可能で、ゲームを通じたコミュニケーションも楽しむことができます。

ステークカジノは、これらの特徴を備え、ユーザーに優れた体験を提供していることが分かります。

↑詳細は今すぐクリック!↑

バカラの基本と遊び方

バカラは、カジノゲームの中でも特に人気が高く、"カジノの王様"とも称されるテーブルゲームです。このゲームでは、ディーラーとプレイヤーが直接競うのではなく、プレイヤーは「プレイヤー」、「バンカー」、「タイ」のいずれかに賭け、その結果を予測します。

プレイの流れ

1.テーブルに座り、賭け金を設定します。

2.ディーラーがプレイヤーとバンカーに2枚ずつのカードを配ります。

3.合計点数が9に近い側が勝利となります。

カードの点数

・数字カード(2~9)はその数字通りの点数です。

・10、J、Q、Kは0点として扱われます。

・Aは1点となります。

引き分けのルール

プレイヤーとバンカーの点数が同じ場合、ゲームは引き分けとなります。

賭け方

バカラでは、以下の3種類の賭け方があります。

・プレイヤー:プレイヤー勝利で賭け金が2倍に。

・バンカー:バンカー勝利で賭け金が1.95倍に。

・タイ:引き分け時、賭け金が8倍に。

攻略法

バカラは直接対決を伴わないため、攻略が難しいとされていますが、以下のような方法があります。

・マーチンゲール法:負けた際に賭け金を倍にし、勝った際は元に戻す。

・ダランベール法:負けた際に賭け金を1単位増やし、勝った際は減らす。

・モンテカルロ法:負けた際に賭け金を1単位減らし、勝った際は増やす。

これらは勝率を向上させるための戦略であり、必ずしも勝利を保証するものではありません。

注意点

バカラは運が大きく影響するゲームです。過度な攻略を目指すのではなく、楽しみながらプレイすることが重要です。

ブラックジャックの基本とプレイ方法

ブラックジャックは、カジノの人気ゲームの一つです。このゲームはディーラーとプレイヤーの間で行われ、カードの合計点数が21に最も近い方が勝者となります。

プレイの手順

1.テーブルに座り、賭け金を置きます。

2.ディーラーが自身とプレイヤーに2枚ずつカードを配ります。

3.プレイヤーは次のアクションを選択します。

・ヒット:カードをもう1枚引きます。

・スタンド:これ以上カードを引かずに現在の点数で勝負します。

・ダブルダウン:賭け金を倍にして、もう1枚だけカードを引きます。

・スプリット:同じ数値のカードが配られた場合、2手に分けてプレイします。

4.ディーラーはプレイヤーのアクションに応じて、以下のルールでカードを引きます。

・手札の合計が16以下なら、カードをもう1枚引きます。

・手札の合計が17以上なら、これ以上引きません。

5.プレイヤーとディーラーの点数を比較し、21に近い方が勝ちとなります。

カードの点数

・2から9までのカードはその数値通りの点数です。

・10、J、Q、Kは10点として計算されます。

・Aは1点または11点として使えます。

引き分けの場合

プレイヤーとディーラーの点数が同じ場合、ゲームは引き分けになります。

攻略法

ブラックジャックは運が影響するゲームですが、以下の戦略で勝率を高めることができます。

・基本戦略:数学的に最適なプレイ方法を決定する戦略です。

・カードカウンティング:配られたカードを数えて、ディーラーの有利・不利を判断する方法です。

注意点

ブラックジャックは運の要素が強いゲームです。無理な攻略をせず、楽しむことを心掛けましょう。

ステークカジノの安全性と信頼性 - 世界中のプレイヤーが選ぶ理由

ステークカジノは、オンラインカジノ界においてその信頼度と安全性で特に高い評価を受けています。このような評判の背後には、プレイヤーが安全に楽しむためのいくつかの重要なポイントが存在します。

ステークカジノのセキュリティは業界トップクラス

ステークカジノでは、プレイヤーの個人データと資金の安全を確保するために128ビットSSL暗号化技術を採用しています。この技術のおかげで、第三者によるプレイヤー情報の不正取得を防ぐことが可能です。加えて、ステークカジノは必要なライセンスを保有し、公平なプレイ環境を提供しているため、プレイヤーは安心してゲームを楽しめます。

また、ステークカジノはセキュリティに関する最新情報を常に提供し、ユーザーが自身を守るための方法を提案しています。例えば、強力なパスワードの設定や、アカウントの二段階認証の導入方法など、安全にプレイするための有用なアドバイスが提供されています。

このような取り組みにより、ステークカジノはユーザーの情報の紛失、盗難、改ざん、無許可アクセスなどのリスクから効果的に保護しています。

ステークカジノについてのQ&A

ステークカジノは、キュラソー政府からライセンスを取得しているオンラインカジノです。ライセンス取得には厳しい審査基準があり、安全性や信頼性が高く、安心してプレイすることができます。また、ステークカジノは、スロット、テーブルゲーム、ライブカジノなど、豊富なゲームが揃っており、自分の好きなゲームをプレイすることができます。さらに、ステークカジノでは、初回入金ボーナスやリロードボーナスなど、お得なキャンペーンが開催されています。これらのキャンペーンを利用することで、より多くの勝利を収めることができるでしょう。

ただし、ステークカジノはギャンブルであり、必ず勝つとは限りません。勝つためには、ゲームのルールを理解し、自分の資金管理をしっかり行うことが重要です。また、勝ちすぎてはまらないように、自己規制することも大切です。

ステークカジノは、安全性や信頼性が高く、お得なキャンペーンも開催されているオンラインカジノです。しかし、ギャンブルであることを忘れずに、勝つための戦略を立ててプレイしましょう。

ステークカジノでは本人確認が必要です。入出金を行う際には、本人確認書類の提出が必要となります。本人確認書類は、以下のいずれかが必要です。

・運転免許証

・パスポート

・住民票

・マイナンバーカード

本人確認書類は、鮮明な画像でアップロードする必要があります。また、書類に記載されている氏名、住所、生年月日がアカウント情報と一致している必要があります。

本人確認書類の提出がない場合、出金が遅延する可能性があります。また、悪質な利用と判断された場合、アカウントが停止される可能性があります。

ステークカジノ(Stake Casino)の結論

ステークカジノ(Stake Casino)は、オンラインで楽しめるカジノゲームのプラットフォームです。

このカジノでは、スロットマシン、ブラックジャック、ルーレット、ポーカーなど様々なゲームを提供しており、多彩な選択肢が魅力です。

2021年に日本語対応サイトが開設された比較的新しいプラットフォームですが、海外では総合格闘技団体やサッカーチームをスポンサーすることで知名度が高く、信頼性も評価されています。

ステークカジノは、先進のグラフィック技術を駆使して、リアルなカジノ体験を提供しています。プレイヤーはリアルタイムでの対戦を楽しむことができ、他のプレイヤーとの交流も可能です。

また、ステークカジノはユーザーの個人情報や取引データの安全を大切にしており、安心してゲームを楽しむことができる安全な環境を整えています。

| ライセンス | キラソー |

| 【当サイト限定】ボーナス関係 |

最大2000ドル |

| 登録ボーナス | なし |

| 入金方法 | 仮想通貨(ビットコイン・イーサリアム・ライトコイン・ドージコイン・ビットコインキャッシュ・リップル・トロン・イオス)、銀行振込、クレジットカード、タイガーペイ、クレカ入金(JCB,Master) |

| 出金方法 | 仮想通貨(ビットコイン・イーサリアム・ライトコイン・ドージコイン・ビットコインキャッシュ・リップル・トロン・イオス)、銀行送金 |

| 運営会社 | Medium Rare N.V. |

| 日本語サポート | あり |

| ライブチャット | 24時間 年中無休 |

| メール | support@stake.com(毎日 24時間受付) |

以上が、ステークカジノ(Stake Casino)についての簡潔なまとめです。

↑詳細は今すぐクリック!↑

プロスポーツのメインスポンサー活動

ステークカジノは、世界規模のボクシング試合やスポーツチームとのスポンサー契約を通じて、その名声を広げています。

具体的には、井上尚弥とノニト・ドネアの注目の試合や、エバートンFC、ワトフォードFCなど、世界的に人気のスポーツイベントやチームにスポンサーとして名を連ねています。

特に井上尚弥対ノニト・ドネア戦では、ステークカジノのロゴがリングや会場に顕著に表示され、大きな注目を集めました。エバートンFCではメインスポンサーとして、チームのユニフォームやスタジアムにもロゴが掲載され、積極的な宣伝活動を展開しています。

さらに、ヒップホップ界の大物ドレイクや、UFCのトップファイターであるイスラエル・アデサニヤ、ジョゼ・アルドなど、有名なアスリートやアーティストとのパートナーシップを結んでいます。

このような多方面での露出により、ステークカジノはスポーツやエンターテイメントのファンにアピールし、その知名度を世界的に高めています。

ステークカジノが那須川天心選手のボクシングデビュー戦を盛り上げた!

日本の格闘技界で注目を集める那須川天心選手が、2023年4月8日に東京・有明アリーナでプロボクシングデビューを果たしました。この記念すべき試合の公式冠スポンサーとなったのが、世界最大級のオンラインカジノ「ステークカジノ」です。

試合は、那須川選手が与那覇勇気選手に3-0の判定勝利を収め、白星デビューを飾りました。ステークカジノは、試合の盛り上げに大きく貢献したと言えるでしょう。

ステークカジノは、アジアで最も急成長しているオンラインカジノです。信頼性と安全性が高く、豊富なゲームコレクションを提供しています。また、スポーツベッティングやeスポーツなど、多様な分野にも進出しています。

那須川選手は、キックボクシングの大会で数々のタイトルを獲得したスター選手です。ボクシング転向後も、その強さを発揮し続けています。

ステークカジノと那須川選手のコラボレーションは、今後も注目を集めていくことでしょう。

↑1分で登録して、ベットするには今すぐクリック!↑

ステークカジノはeスポーツにも対応!

ステークカジノでは、eスポーツのベッティングに加え、サッカー、バスケットボール、アメリカンフットボールなどの従来のスポーツもベットの対象となっています。

eスポーツベッティングが特徴的なステークカジノでは、人気のeスポーツタイトルに加え、サッカーやバスケットボール、アメリカンフットボールなどの伝統的なスポーツも幅広く取り揃えています。

ユーザーは、試合の勝敗、スコア、最優秀選手(MVP)など、多様な賭けのオプションから選べます。さらに、ライブベッティングも提供されているため、試合が進行する中でのベッティングが可能です。

ステークカジノのeスポーツベットは、40種類以上のスポーツに対応しており、多様なスポーツファンのニーズに応えています。お気に入りのスポーツがあるかどうか、ぜひチェックしてみてください。

ただし、現在のところ日本の野球や競馬へのベットは利用できない点には注意が必要です。

ステークカジノでeスポーツに賭ける方法は?

ステークカジノでeスポーツに賭ける際には、次のステップを踏む必要があります。

1.アカウントを開設

ステークカジノの公式サイトにアクセスし、メールアドレスとパスワードを使用してアカウントを作成します。登録に関する費用や維持費はかかりません。

2.入金する

ステークカジノは、ビットコイン、イーサリアム、トロン、リップル、ドージコイン、ビットコインキャッシュ、テザーなど、8種類の暗号通貨での入金を受け付けています。

3.eスポーツを選択

スポーツベッティングのセクションに移動し、eスポーツを選びます。サッカー、バスケットボール、アメリカンフットボールなどの一般的なスポーツのほか、人気のあるeスポーツゲームも選択可能です。

4.ベットをする

eスポーツの試合やイベントを選び、賭けたい結果を決めます。賭ける金額を入力し、ベットを確定させます。

5.結果を確認

試合やイベントが終わったら、結果をチェックします。予測が当たれば、賭け金とオッズに応じた勝利金がアカウントに加算されます。

ステークカジノに関する体験談

ステークカジノのプレイヤーアカウントを登録をしてから、これまで利用したカジノの中で最も充実したゲーム体験を得ることができました。オリジナルゲームは単純ですがハマってしまいます。還元率も高く楽しめました。

多くの経験を持つプロのプレイヤーたちもTwitterでステークの魅力を絶賛しており、これがStakeがトップクラスのカジノサイトである証となっています。

ステークカジノでのプレイは非常に快適で、仮想通貨を用いた入出金やゲームプレイが可能です。ビットコインだけでなく、多様な暗号資産の取り扱いがあり、仮想通貨を活用したい方には特におすすめです。

ステークカジノは、海外での成功を経て日本市場に参入しました。イギリスやインド、タイなどでの高評価が、日本のプレイヤーにもきっと伝わるはずです。ステークカジノの良質なサービスは、日本のユーザーにとっても魅力的となっています。

数ヶ月のステークカジノでのプレイを通じて、サイト内での暗号通貨購入機能の追加がさらなる利便性をもたらすと感じました。このことにより、初めての方でも暗号通貨を用いたゲームが始めやすくなっています。

ステークカジノでプレイすることは、多くのプレイヤーにとって最適な選択となるでしょう。ただし、オンラインカジノにはリスクもあります。プレイヤーは自分自身の責任でプレイしてください。リスクは最小限に抑えることが大切です。

ステークカジノでは、2024年3月から安全性のため仮想通貨を含めたほぼ全ての通貨においてウォレットを使用する場合は本人確認(KYCレベル2まで)の登録が必須となりました。

ステークカジノ(Stake.com)への入金方法

ステークカジノへの入金手順は以下のとおりです。

- ステークカジノの公式サイトにアクセスし、アカウントにログインします。

- 画面上部の「ウォレット」をクリックします。

- 「入金」をクリックします。

- 入金方法を選択します。

- 入金額を入力します。

- 「入金」をクリックします。

入金方法は、クレジットカード、デビットカード、電子マネー、仮想通貨などから選択できます。入金額は、10ドルから可能です。

入金が完了すると、すぐにアカウントに反映されます。入金した資金を使って、ステークカジノでゲームをプレイすることができます。

ステークカジノは、ユーザーフレンドリーなインターフェースと豊富なゲーム選択肢だけでなく、その柔軟で手数料無料の入金オプションでも注目を集めています。ステークカジノでは、多種多様な暗号通貨を使用して入金することができます。

入金手数料は無料です。最小入金額は暗号通貨により異なり、例えばビットコインの場合は0.00001 BTC、イーサリアムの場合は0.001 ETHとなっています。最大入金額については、全ての暗号通貨で無制限となっています。

ステークカジノは、幅広いユーザー層に対応しています。少額からでもゲームを楽しむことができ、また、自由に大量の資金を入金し、大きな賭けをすることも可能です。